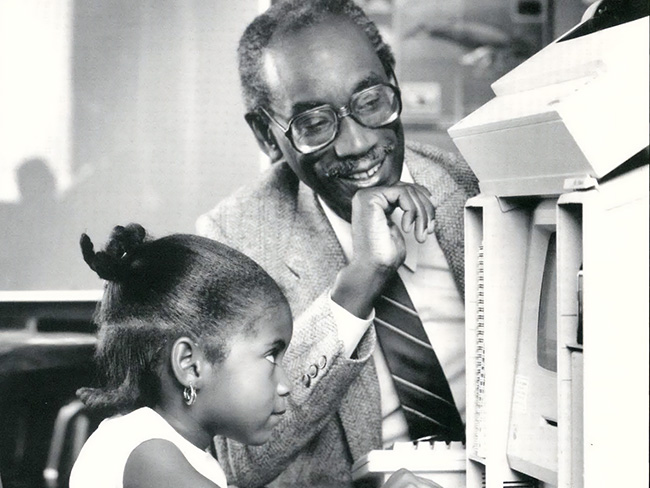

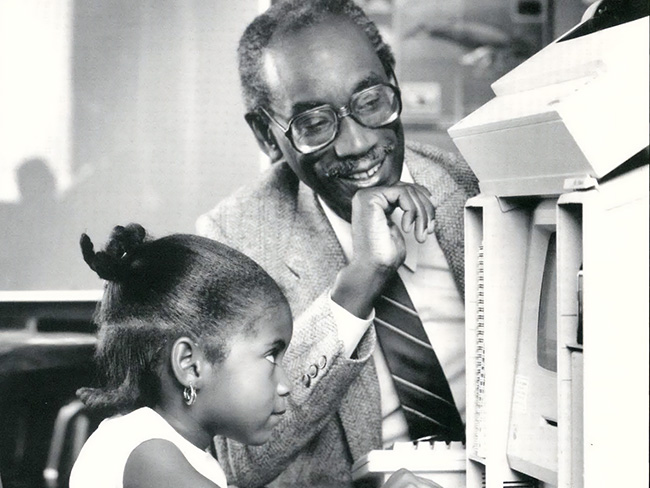

Rent reporting can help millions build credit and thrive

A good credit score can make it easier to buy a home, pay for school, or start a small business. Ensuring renters get credit for on-time payments can help.

Every month more than 1 in 3 households in the United States will pay rent. But, unlike homeowners, when renters make on-time payments, it likely doesn’t help them build credit.

This is one of the ways renters — a majority of whom are nonwhite and have lower incomes — are treated differently in our economy.

“Renters don’t typically get credit for on-time rent payments, though they can be penalized for late or missed payments,” said Richard Reeve, chief program officer at Credit Builders Alliance.

“A lack of credit or bad credit can really cost you, since you end up paying more for the same sorts of services than a person with good credit would. Poor credit costs low-income people an average of $200,000 over their lifetime. That’s higher than the racial wealth gap between Black and white households.”

Rent reporting addresses this inequity head-on.

Narrowing wealth and health gaps

According to Asset Funders Network, more than 73 million Americans pay more for loans because of their credit scores. Lower credit scores — or not having a credit score at all — can make it harder to build wealth that can be passed on to future generations. This is especially true for communities of color, which have been historically and persistently discriminated against by the financial system.

Reporting on-time rent payments to credit bureaus, also known as rent reporting, could:

- Help renters realize the benefits of better credit, including qualifying for loans that can help them buy a home, pay for school, or even start a business

- Increase on-time rent payments and improve relationships between renters and landlords

- Broaden opportunities for employment and small-business ownership for renters

The downstream effects of rent reporting can help reverse the widening wealth gap in the United States, which could in turn have a profound effect on health. Wealth provides people and families greater access to factors that promote good health, like safe and stable housing, healthy food, and reduced stress.

“Health is strongly affected by both wealth and income,” said Stephanie Ledesma, vice president of community health programs for Kaiser Permanente. “Everyone should have access to safe and fair financial products and services to help them save what they can, borrow when they need to, and build wealth for the long term.”

Breaking cycles of poverty

Kaiser Permanente is working with Credit Builders Alliance — an organization committed to closing gaps that lock millions of individuals with lower, invisible, or no credit out of the mainstream financial system — to increase access to rent reporting services.

In 2020, Credit Builders Alliance introduced a rent reporting program through the District of Columbia Housing Authority. Among the residents participating in rent reporting, 75% have seen an improvement in their credit score by an average of 29 points, 4 were able to establish a credit score for the first time, and at least 1 was able to realize her dream of homeownership.

As part of our efforts to strengthen equitable economic opportunity, over the next 2 years Kaiser Permanente will provide $450,000 in grant funding and technical assistance to help 60 to 80 organizations offer robust rent reporting and other credit-building programs to Americans with low incomes.

One of those organizations is Neighbor to Neighbor, based in Colorado. Our grant will help Neighbor to Neighbor cover rent reporting fees and help renters manage their finances.

“We’re really interested in breaking cycles of intergenerational poverty, which are so often tied to credit, access to owning a home, and financial literacy,” said Christy Hayes, director of community operations at Neighbor to Neighbor. “For less than $2 a month per person, our residents will have access to rent reporting, including credit building and financial education. It’s a small investment with so much potential.”

-

Social Share

- Share Rent Reporting Can Help Millions Build Credit and Thrive on Pinterest

- Share Rent Reporting Can Help Millions Build Credit and Thrive on LinkedIn

- Share Rent Reporting Can Help Millions Build Credit and Thrive on Twitter

- Share Rent Reporting Can Help Millions Build Credit and Thrive on Facebook

- Print Rent Reporting Can Help Millions Build Credit and Thrive

- Email Rent Reporting Can Help Millions Build Credit and Thrive

March 27, 2025

We’re committed to mentorship, mental health, and communities

Kaiser Permanente awarded Elevate Your G.A.M.E. a grant to expand program …

March 25, 2025

AI in health care: 7 principles of responsible use

These guidelines ensure we use artificial intelligence tools that are safe …

March 17, 2025

Remembering Bill Coggins and his lasting legacy

The founder of the Kaiser Permanente Watts Counseling and Learning Center …

December 26, 2024

Linking isolated communities to care

A collaborative partnership, powered by trusted nonprofit partners, brings …

December 16, 2024

Helping to build and support inclusive communities

At the Special Olympics Southern California Fall Games, Kaiser Permanente …

November 11, 2024

Medicare telehealth flexibilities should be here to stay

We urge Congress to extend policies that have improved access to care and …

November 11, 2024

Health care coverage now accessible to uninsured people

Indigenous farmworkers may qualify for new Kaiser Permanente coverage.

November 6, 2024

A best place to work for veterans

As a 2024 top Military Friendly Employer, Kaiser Permanente supports veterans …

October 15, 2024

Our dedication to fostering well-being and equity

The 2023 Kaiser Permanente Southern California Community Health County …

October 2, 2024

Honored for supporting people with disabilities

Leading U.S. disability organizations recognize Kaiser Permanente for supporting …

October 2, 2024

A new lease on life

Kaiser Permanente’s medical-legal partnership offers a lifeline for members …

September 16, 2024

Voting affects the health of our communities

In honor of National Voter Registration Day, we encourage everyone who …

July 16, 2024

Teacher residency program improves retention and diversity

A $1.5 million Kaiser Permanente grant addresses Colorado teacher shortage …

July 2, 2024

Reducing cultural barriers to food security

To reduce barriers, Food Bank of the Rockies’ Culturally Responsive Food …

June 19, 2024

Investments in Black community promote total health for all

Funding from Kaiser Permanente in Washington helps to promote mental health, …

May 30, 2024

Special Olympics Summer Games: Will you play a part?

Kaiser Permanente employee Carrie Zaragoza volunteers for Special Olympics …

May 14, 2024

Recognized again for leadership in diversity and inclusion

Fair360 names Kaiser Permanente to its Top 50 Hall of Fame for the seventh …

May 7, 2024

Can the badly broken prescription drug market be fixed?

Prescription drugs are unaffordable for millions of people. With the right …

April 12, 2024

It’s time to address America’s Black maternal health crisis

Health care leaders and policymakers should each play their part to help …

April 8, 2024

Reducing inequity with fruits and vegetables

Black Americans experience worse health outcomes compared to other populations. …

April 8, 2024

Martin Luther King Jr.’s dream is alive at Kaiser Permanente

Greg A. Adams, chair and chief executive officer of Kaiser Permanente, …

March 18, 2024

Program helps member prioritize her health

Medical Financial Assistance program supports access to health care.

March 6, 2024

Former employee honored for supporting South LA families

Bill Coggins, who founded the Kaiser Permanente Watts Counseling and Learning …

March 4, 2024

Taking care of Special Olympics athletes

Kaiser Permanente physicians and medical students provide medical exams …

February 26, 2024

Patients can apply for help with medical bills

Kaiser Permanente offers financial assistance for people struggling to …

February 2, 2024

Expanding medical, social, and educational services in Watts

Kaiser Permanente opens medical offices and a new home for the Watts Counseling …

January 10, 2024

‘You don’t know unless you ask them’

Kaiser Permanente’s Patient Advisory Councils help us create exceptional …

December 20, 2023

Championing inclusivity at the Fall Games

Kaiser Permanente celebrates inclusion at Special Olympics Southern California …

December 7, 2023

Safe, secure housing is a must for health

We offer housing-related legal help to prevent evictions and remove barriers …

December 6, 2023

Solid foundation: How construction careers support health

Steady employment can improve a person's health and well-being. Our new …

November 1, 2023

Meet our 2023 to 2024 public health fellows

To help develop talented, diverse community leaders, Kaiser Permanente …

October 11, 2023

Expanded gun violence prevention efforts

The next phase for the Kaiser Permanente Center for Gun Violence Research …

August 15, 2023

'Hot-spot' strategy gets more Californians vaccinated

A new location-based vaccine strategy by Kaiser Permanente was successful …

August 10, 2023

Highlighting our community health work in Southern California

The Kaiser Permanente Southern California 2022 Community Health Snapshot …

August 2, 2023

Social health resources are just a click or call away

The Kaiser Permanente Community Support Hub can help members find community …

June 30, 2023

Our response to Supreme Court ruling on LGBTQIA+ protections

Kaiser Permanente addresses the Supreme Court decision on LGBTQIA+ protections …

June 29, 2023

Our response to Supreme Court's ruling on affirmative action

Kaiser Permanente addresses the Supreme Court decision on affirmative action …

June 29, 2023

Special Olympics athletes go for the gold

Kaiser Permanente celebrated its sixth year as official health partner …

June 20, 2023

Helping entrepreneurs in under-resourced communities

Kaiser Permanente's support of Inner City Capital Connections program helps …

June 14, 2023

Honored for commitment to people with disabilities

The Achievable Foundation recognized Kaiser Permanente for its work to …

June 7, 2023

Engaging businesses for action on climate and health equity

New climate collaborative with BSR announced at joint Kaiser Permanente …

May 22, 2023

Investing and partnering to build healthier communities

Kaiser Permanente supports Asian Americans Advancing Justice to promote …

May 16, 2023

How we help people access financial literacy skills

Kaiser Permanente is working with community partners to reduce financial …

May 10, 2023

A workplace for all

We value and respect employees and physicians of all backgrounds, identities, …

May 10, 2023

Equity, inclusion, and diversity

We strive for equity and inclusion for all.

May 2, 2023

Women lead an industrial revolution at the Kaiser Shipyards

Early women workers at the Kaiser shipyards diversified home front World …

April 27, 2023

Inspiring students to pursue health care careers

Kaiser Permanente is confronting future health care staffing challenges …

April 25, 2023

Hannah Peters, MD, provides essential care to ‘Rosies’

When thousands of women industrial workers, often called “Rosies,” joined …

April 11, 2023

Collaboration is key to keeping people insured

With the COVID-19 public health emergency ending, states, community organization …

April 7, 2023

Increasing access to health care

Kaiser Permanente launches new mobile health vehicle on Oahu.

April 5, 2023

Housing help brings stability to patients’ lives

With medical-legal partnerships, we’re helping prevent evictions. Patients …

April 3, 2023

Hospital patients who are homeless connected to housing

A Kaiser Permanente program connects patients experiencing homelessness …

March 29, 2023

Supporting a safer future with public health

We’re partnering on 3 initiatives to strengthen public health in the United …

March 29, 2023

Volunteering helps create healthier communities

Kaiser Permanente’s partnership with Special Olympics Southern California …

March 28, 2023

Sentenced to prison, not a life of bad health

Reentering society after serving time can land people in unhealthy situations. …

March 14, 2023

Named among World’s Most Ethical Companies for 5th time

Organizations that receive this recognition improve communities, build …

March 13, 2023

Making waves with our first female sports ambassador

Kaiser Permanente in Southern California partners with San Diego Wave Fútbol …

March 2, 2023

Improving the health of the community

Kaiser Permanente awards $80,000 in grants for health policy and community …

February 28, 2023

A conversation about pregnancy and women’s heart health

New research shows blood pressure patterns early in pregnancy can identify …

February 17, 2023

Good health starts in our communities: 2022 by the numbers

Kaiser Permanente supports total health in our communities in partnership …

February 3, 2023

Addressing health and housing insecurity

Kaiser Permanente supports 3 Hawaii-based nonprofits.

February 2, 2023

Addressing social isolation in the Northwest

Kaiser Permanente invests $3.3 million to build healthy social connections …

January 17, 2023

Lawmakers must act to boost telehealth and digital equity

Making key pandemic-era telehealth policies permanent and ensuring more …

November 14, 2022

It’s time to rethink health care quality measurement

To meaningfully improve health equity, we must shift our focus to outcomes …

November 11, 2022

Early leaders in equity and inclusion

Explore Kaiser Permanente’s commitment to equitable, culturally responsive …

November 11, 2022

High-quality, equitable care

We believe everyone has a right to good health.

November 8, 2022

Protecting access to medical care for legal immigrants

A statement of support from Kaiser Permanente chair and CEO Greg A. Adams …

August 19, 2022

Improving financial literacy

Kaiser Permanente announces $50,000 grant to Goodwill Hawaii.

August 8, 2022

Kaiser Permanente and Medical Teams launch mobile services

Mobile dental and medical clinics are now available for uninsured individuals …

July 29, 2022

Health care workforce

Strengthening America’s health care workforce

July 19, 2022

Connecting people to financial coaching

Debt, bad credit, and other money matters can affect a person’s physical …

May 27, 2022

Grants help AAPI communities and businesses

Kaiser Permanente is working with community organizations and businesses …

May 4, 2022

Donated supplies keep community organizations pandemic-ready

We donated over $28 million worth of face masks, hand sanitizer, and other …

March 22, 2022

Our commitment to equity and our LGBTQIA+ communities

A statement from chair and chief executive officer Greg A. Adams.

February 28, 2022

Private investments in housing are critical — and not enough

Public policy changes and private investments together are needed to end …

February 21, 2022

A best place to work for LGBTQ+ equality

Human Rights Campaign Foundation gives Kaiser Permanente another perfect …

December 6, 2021

Faith leaders use trusted voices to encourage vaccination

Grants expand support for faith-based organizations working to protect …

August 25, 2021

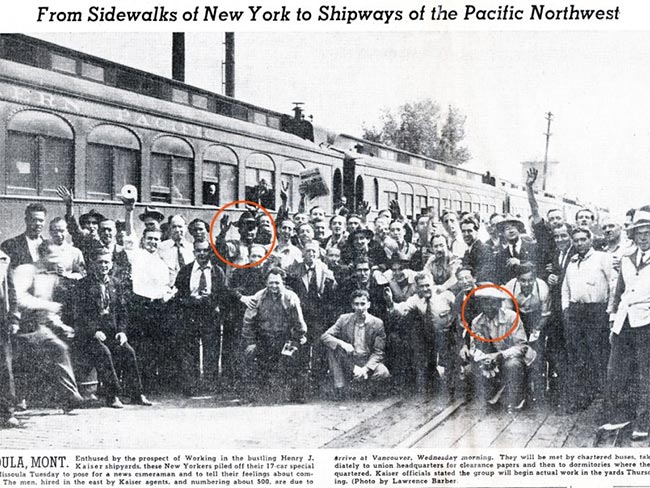

Kaiser Permanente’s history of nondiscrimination

Our principles of diversity and our inclusive care began during World War …

August 19, 2021

Supporting small businesses owned by people of color

Kaiser Permanente’s partnership with Local Initiatives Support Corporation, …

July 22, 2021

A long history of equity for workers with disabilities

In Henry J. Kaiser’s shipyards, workers were judged by their abilities, …

July 7, 2021

Achieving health equity

Equal medical care is not enough to end disparities in health outcomes.

June 2, 2021

Path to employment: Black workers in Kaiser shipyards

Kaiser Permanente, Henry J. Kaiser’s sole remaining institutional legacy, …

May 24, 2021

Supporting access to telehealth for vulnerable populations

Kaiser Permanente grants help fund community organizations working to expand …

April 30, 2021

Our support for banning menthol cigarettes, flavored cigars

Kaiser Permanente applauds the Food and Drug Administration’s commitment …

April 28, 2021

COVID-19 outcomes are more severe for people of color

Kaiser Permanente research underscores the importance of culturally appropriate …

March 23, 2021

Vaccine Equity Toolkit will help address equitable access

As vaccines bring hope to end the pandemic, Kaiser Permanente’s toolkit …

February 22, 2021

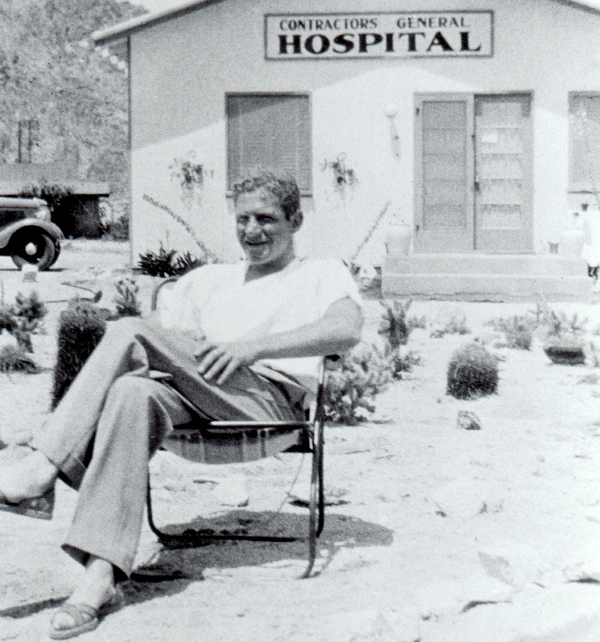

The Permanente Richmond Field Hospital

Forlorn and all but forgotten, it played a proud role during the World …

October 7, 2020

Advancing health equity in education and the workplace

Kaiser Permanente supports California measure allowing universities and …

July 21, 2020

Transcending language barriers in health care for decades

Good communication is key to good health. During Kaiser Permanente’s 75th …

November 8, 2019

Swords into stethoscopes — veterans in health professions

Kaiser Permanente has actively hired veterans in all capacities since World …

August 28, 2019

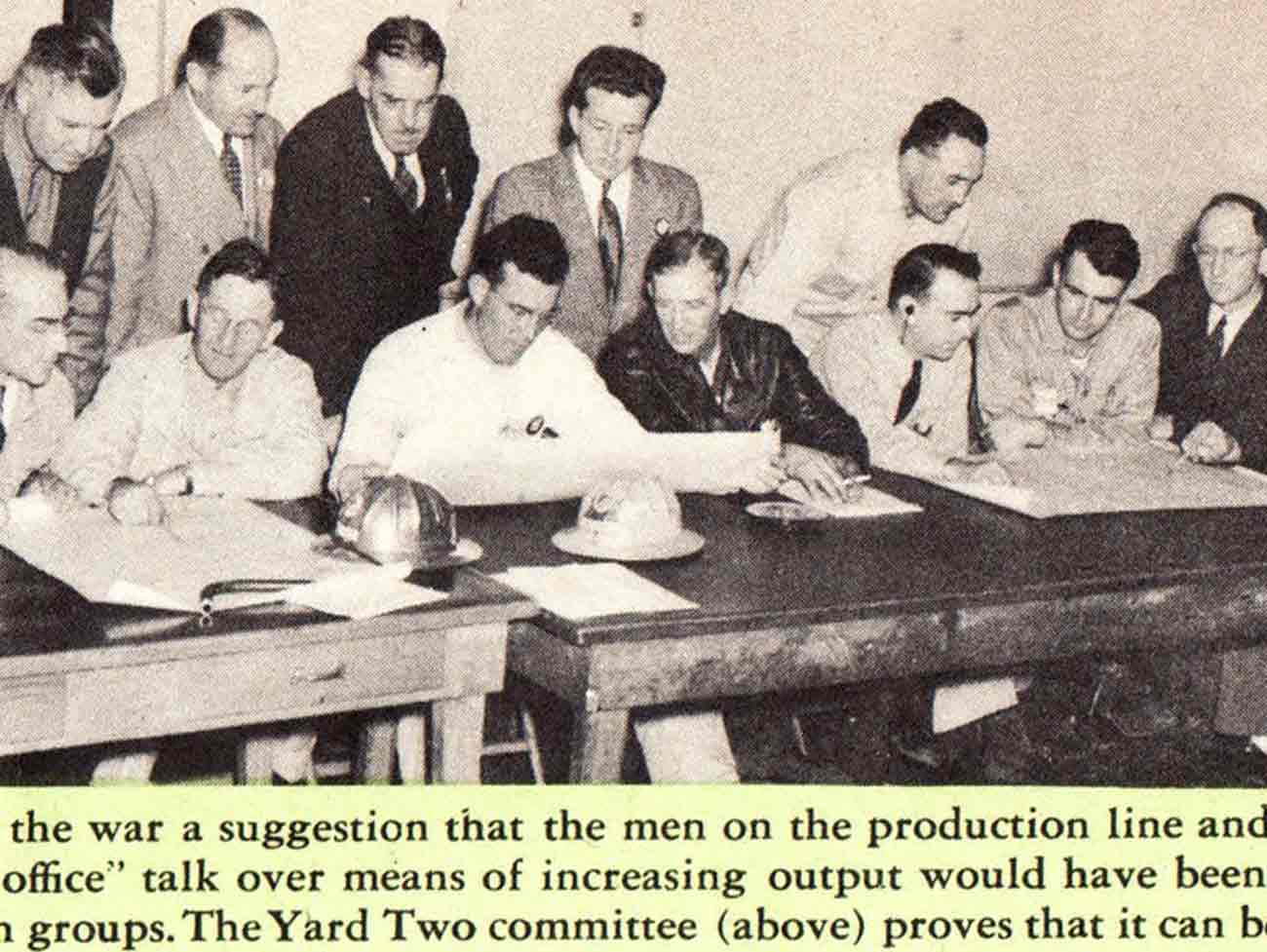

When labor and management work side by side

From war-era labor-management committees to today’s unit-based teams, cooperatio …

June 5, 2019

Breaking LGBT barriers for Kaiser Permanente employees

“We managed to ultimately break through that barrier.” — Kaiser Permanente …

March 29, 2019

Equal pay for equal work

Kaiser shipyards in Oregon hired the first 2 female welders at equal pay …

March 26, 2018

5 physicians who made a difference

Meet 5 outstanding doctors who advanced the practice of medical care with …

March 8, 2018

Slacks, not slackers — women’s role in winning World War II

Women who worked in the Kaiser shipyards helped lay the groundwork for …

February 22, 2018

The amazing true story of Park Ranger Betty Reid Soskin

She is the oldest national park ranger in the country with a legacy of …

November 7, 2017

Patriot in pinstripes: Honoring veterans, home front, and peace

Henry J. Kaiser's commitment to the diverse workforce on the home front …

October 12, 2017

An experiment named Fabiola

Health care takes root in Oakland, California.

August 10, 2017

‘Good medicine brought within reach of all'

Paul de Kruif, microbiologist and writer, provides early accounts of Kaiser …

March 7, 2017

Beatrice Lei, MD: From Shantou, China, to Richmond, California

She served as a role model and inspiration to the women physicians and …