California employers, meet our smarter Choice plan

Kaiser Permanente Plus™ more affordably adds some out-of-network flexibility to Kaiser Permanente’s high-quality, integrated care.

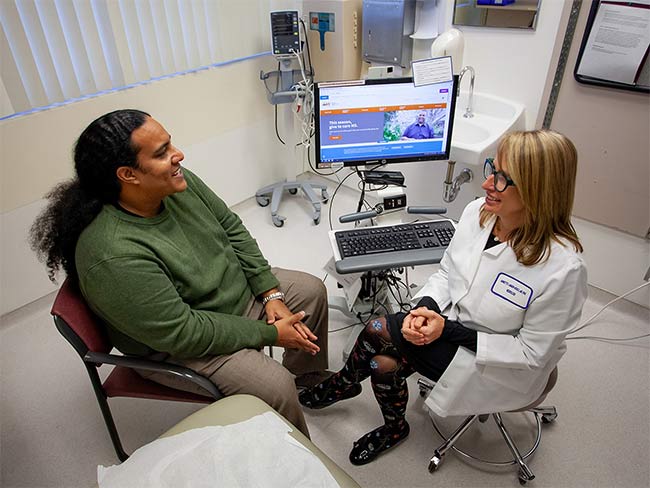

Kaiser Permanente is primarily known for our highly rated HMO plans. Enter Kaiser Permanente Plus.™

We designed this commercial product to bring some provider flexibility to the quality and value of our integrated care offering.

Now California’s large and small businesses can get quotes for KP Plus plans with coverage beginning January 1, 2026.

Quality, flexibility, affordability

KP Plus is a Choice health plan product. It combines Kaiser Permanente’s industry-leading care with a set out-of-network benefits. KP Plus makes it easier for employers and their employees to choose Kaiser Permanente.

In California, KP Plus is a limited point-of-service, or POS, plan with coverage for certain outpatient services and prescriptions from out-of-network providers as described in each plan’s Evidence of Coverage.

Key features include:

- High-quality, patient-centered care from Kaiser Permanente

- Built-in flexibility with limited out-of-network benefits (subject to exclusions) for people who live on the edge of a service area or want to keep seeing a favorite provider

- Generally lower monthly rates compared to typical preferred provider organization or point-of-service plans

Smarter Choice

Employers appreciate the ease of administering one plan. KP Plus clears a path to making Kaiser Permanente their sole health benefits solution.

“Brokers, consultants, benefit managers, and employers across industries - they’re looking at Kaiser Permanente in a new way,” said Andrea Seals Arnold, area vice president for National Sales at Kaiser Permanente.

“With KP Plus, they see the opportunity to explore Kaiser Permanente as one solution that can manage costs, offer meaningful choice, and provide high-quality care, while giving employees the ability to ease into Kaiser Permanente.”

KP Plus out-of-network benefits

$0 copay

for routine preventive care

10 office visits

or covered outpatient medical services per year

5 prescriptions

or refills per year

No referrals

or preauthorization needed for covered out-of-network care

More features, more value

KP Plus plans come with built-in features members value, such as:

- Convenient, all-under-one-roof access to connected care teams

- 24/7 virtual care

- A focus on accessible, often $0 copay preventive services that reduce ongoing conditions and higher-cost treatments

- Prescriptions and refills through Kaiser Permanente pharmacies and by mail

As members, KP Plus plan participants also have access to:

- No-cost self-care and mental wellness apps

- Fitness products and services at reduced cost

- Wellness coaching by phone and online healthy lifestyle tools at no cost

Where it’s available

KP Plus and Choice products like it are available in all Kaiser Permanente markets: Colorado, Georgia, Hawaii, metropolitan Baltimore, Washington, D.C., Northern Virginia, Oregon, and Washington state.

With the 2025 expansion to California, this product is also an option for national and multi-state businesses.

Plan participants must live or work in a Kaiser Permanente service area.

Brokers, businesses, and benefit managers can explore these resources and contact Kaiser Permanente to learn more.

-

Social Share

- Share California Employers, Meet Our Smarter Choice Plan on Pinterest

- Share California Employers, Meet Our Smarter Choice Plan on LinkedIn

- Share California Employers, Meet Our Smarter Choice Plan on Twitter

- Share California Employers, Meet Our Smarter Choice Plan on Facebook

- Print California Employers, Meet Our Smarter Choice Plan

- Email California Employers, Meet Our Smarter Choice Plan

January 29, 2026

New Lakewood Medical Offices welcome first members

Kaiser Permanente’s new Lakewood Medical Offices in Colorado opened to …

August 27, 2025

New Pueblo North facility opens to serve future generations

Members, physicians, staff, and community leaders celebrated the new medical …

August 13, 2025

Celebrating 80: Kenneth Barnhart shares why he’s a member

As we celebrate our 80th anniversary, one member describes the high-quality, …

August 11, 2025

Investing in the future of health care

Kaiser Permanente is actively partnering to expand the physician career …

July 25, 2025

Celebrating the new Kaiser Permanente Parker Medical Offices

The new facility opened in July 2025 with a ribbon-cutting ceremony and …

July 15, 2025

A new chapter of Kaiser Permanente’s hospital care is born

Kaiser Permanente physicians and staff are now caring for patients at several …

June 26, 2025

Our commitment to vaccine access

Kaiser Permanente’s statement on vaccine access.

June 17, 2025

We must grow the health care workforce

At Kaiser Permanente, we educate future clinicians and offer programs that …

June 16, 2025

Getting care while traveling made easier

Kaiser Permanente’s agreement with Cigna provides our members with more …

May 7, 2025

Denver unveils health clinic air monitors

Kaiser Permanente helps Love My Air provide real-time information about …

February 20, 2025

Kaiser Permanente joins Food Is Medicine Colorado coalition

As an inaugural member, Kaiser Permanente will help lead health care’s …

December 10, 2024

Accelerating growth in the mental health care workforce

Actions policymakers can take to grow and diversify the mental health care …

October 15, 2024

Our dedication to fostering well-being and equity

The 2023 Kaiser Permanente Southern California Community Health County …

September 19, 2024

First look at new Lakewood facilities

New medical offices will enhance the health care experience for members …

September 17, 2024

Groundbreaking at new medical offices in Pueblo

The new Pueblo North Medical Offices will replace the existing facility …

August 28, 2024

Final beams placed at Parker Medical Offices

The final steel beams for the new Kaiser Permanente Parker Medical Offices …

July 25, 2024

Breaking ground on bigger, better offices in Parker

The new Kaiser Permanente Parker Medical Offices in Colorado, which are …

July 10, 2024

Grant to help make school lunches healthier for kids

Chef Ann Foundation will use $275,000 grant for Colorado program to convert …

June 28, 2024

Operation Splash makes a splash for safe summer fun

Kaiser Permanente is making waves this summer, ensuring that communities …

June 3, 2024

A call to ‘Connect’ for cancer prevention research

Participate in a study to help uncover the causes of cancer and how to …

May 24, 2024

Investing to meet health care needs

The new Wildomar Trail Medical Offices offer additional opportunities for …

May 7, 2024

Making cancer care more convenient in Southern California

Kaiser Permanente has opened a new Radiation Oncology Center at the Bellflower …

April 25, 2024

Expanding access to cancer care in Southern California

Kaiser Permanente has opened a new Radiation Oncology Center and MRI Center …

April 23, 2024

We’re rising up to help prevent falls

Kaiser Permanente is committed to finding ways to help reduce falls in …

March 26, 2024

Donations assure access to affordable health care

Kaiser Permanente grant and challenge spark $18.7 million for Denver Health’s …

March 18, 2024

Program helps member prioritize her health

Medical Financial Assistance program supports access to health care.

February 26, 2024

Patients can apply for help with medical bills

Kaiser Permanente offers financial assistance for people struggling to …

February 2, 2024

Expanding medical, social, and educational services in Watts

Kaiser Permanente opens medical offices and a new home for the Watts Counseling …

January 31, 2024

Prioritizing policies for health and well-being in Colorado

CityHealth’s 2023 Annual Policy Assessment awards cities for their policies …

December 20, 2023

Research transforms care for people with multiple sclerosis

Our researchers are leading the way to more effective, affordable, and …

December 6, 2023

Leading research with gratitude

Learn how you can participate in a study to uncover what causes cancer …

September 13, 2023

Transforming the medical record

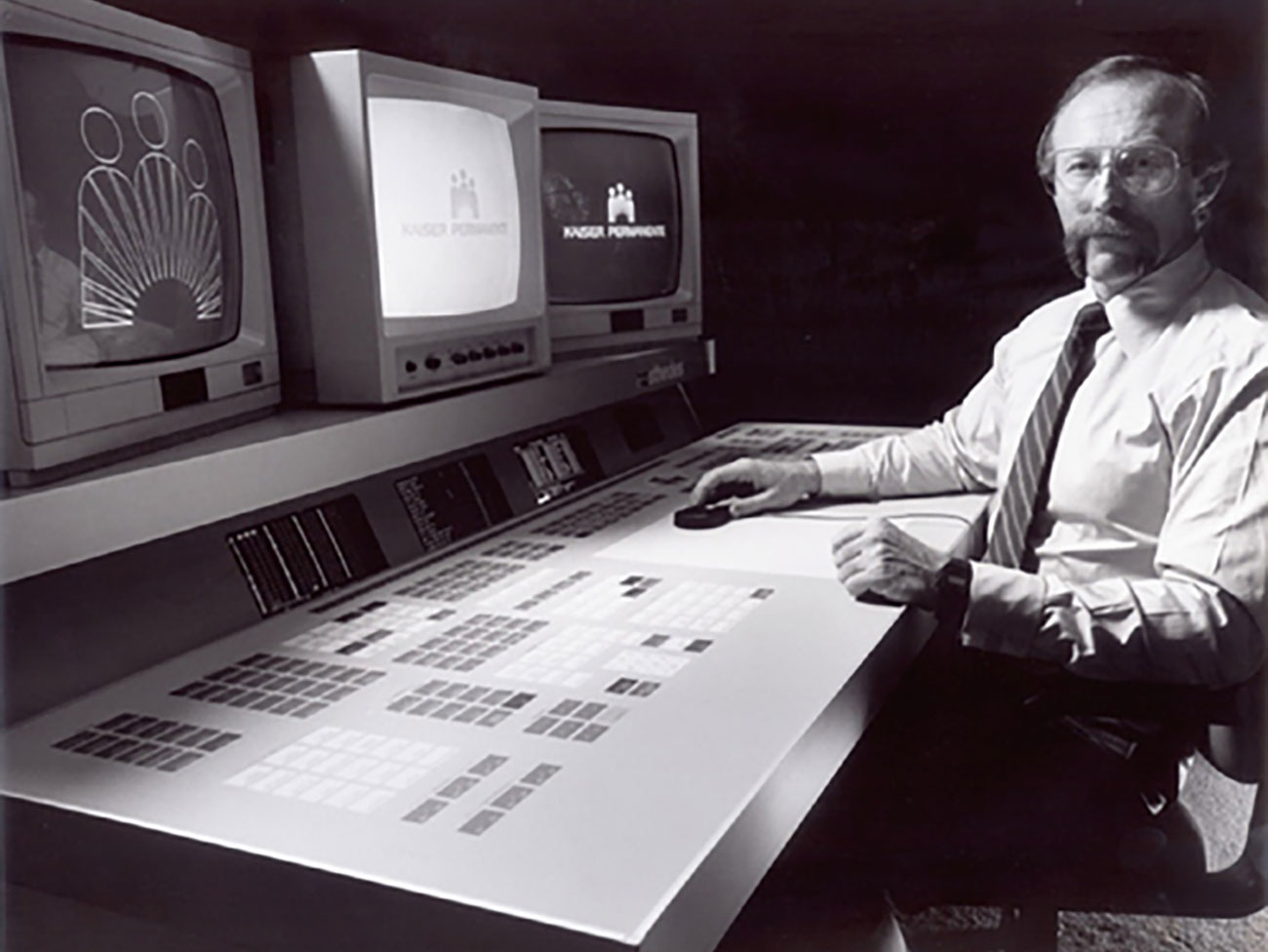

Kaiser Permanente’s adoption of disruptive technology in the 1970s sparked …

September 6, 2023

Advancing mental health crisis care through public policy

Organizations that provide public mental health crisis services must work …

August 28, 2023

Grants improve the total health of our communities

Kaiser Permanente increases access to mental health services in Southern …

August 2, 2023

Social health resources are just a click or call away

The Kaiser Permanente Community Support Hub can help members find community …

June 30, 2023

Our response to Supreme Court ruling on LGBTQIA+ protections

Kaiser Permanente addresses the Supreme Court decision on LGBTQIA+ protections …

June 1, 2023

Policy recommendations from a mental health therapist in training

Changing my career and becoming a therapist revealed ways our country can …

May 30, 2023

Kaiser Permanente commits up to $10 million to Denver Health

Funding comes as Denver Health provided $120 million in uncompensated care …

May 22, 2023

Investing and partnering to build healthier communities

Kaiser Permanente supports Asian Americans Advancing Justice to promote …

May 19, 2023

Partnering to improve the health of homeless individuals

Grant funds will combat housing inaccessibility and improve health care …

May 17, 2023

Accelerating value in health care

An op-ed by Geisinger Health board of directors members Gail R. Wilensky, …

May 11, 2023

COVID-19 testing, testing — Get results in 1, 2, 3

Testing is the most important way you can help control the spread of COVID-19.

May 8, 2023

Risant Health captures national attention

Creation of new nonprofit and pending acquisition of Geisinger Health advances …

April 26, 2023

Risant Health launches with Geisinger

New nonprofit accelerates value-based care with leading community-based …

April 25, 2023

Hannah Peters, MD, provides essential care to ‘Rosies’

When thousands of women industrial workers, often called “Rosies,” joined …

January 17, 2023

Lawmakers must act to boost telehealth and digital equity

Making key pandemic-era telehealth policies permanent and ensuring more …

November 11, 2022

Our integrated care model

We’re different than other health plans, and that’s how we think health …

November 8, 2022

Protecting access to medical care for legal immigrants

A statement of support from Kaiser Permanente chair and CEO Greg A. Adams …

October 5, 2022

Safe travels: Our members now have more U.S. care options

Need urgent care in Florida? Michigan? Alaska? Here are 2 ways we’ve made …

February 22, 2021

The Permanente Richmond Field Hospital

Forlorn and all but forgotten, it played a proud role during the World …

February 5, 2019

Mobile clinics: 'Health on wheels'

Kaiser Permanente mobile health vehicles brought care to people, closing …

December 10, 2018

Southern comfort — Dr. Gaston and The Southeast Permanente Medical Group

Local Atlanta physicians built community relationships to start Kaiser …

August 15, 2017

Sidney R. Garfield, MD, on medical care as a right

Hear Kaiser Permanente’s physician co-founder talk about what he learned …

March 22, 2017

Kaiser Permanente and Group Health Cooperative: Working together since …

The formation of Kaiser Permanente Washington comes from longstanding collaboration, …

March 1, 2017

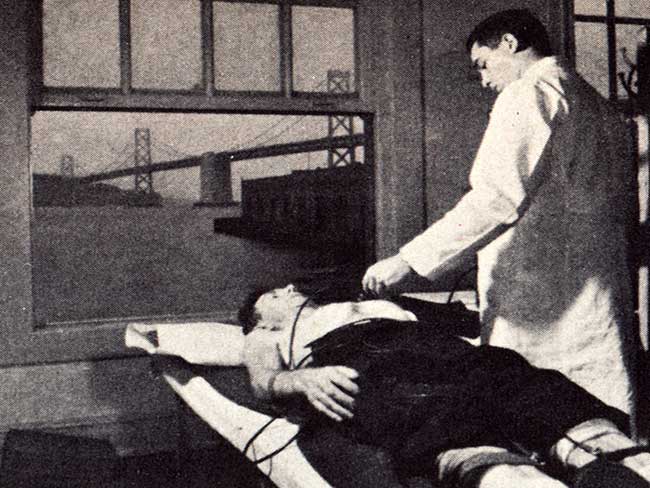

Screening for better health: Medical care as a right

When industrial workers joined the health plan, an integrated battery of …

September 23, 2015

Kaiser Permanente and NASA — taking telemedicine out of this world

Kaiser Permanente International designs, develop, and test a remote health …

July 20, 2015

Opening the Permanente plan to the public

On July 21, 1945, Henry J. Kaiser and Dr. Sidney Garfield offered the health …

July 23, 2014

Kaiser shipyards pioneered use of wonder drug penicillin

Though supplies for civilians were limited, Dr. Morris Collen’s wartime …

June 24, 2014

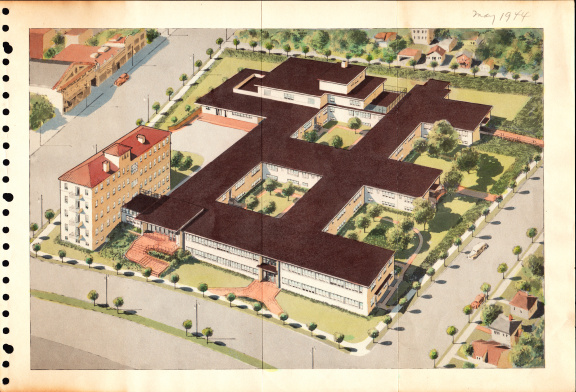

Kaiser Permanente's first hospital changes and grows

A collection of vintage photos that chronicle the evolution of Oakland …

February 18, 2014

Alva Wheatley: Champion of Kaiser Permanente diversity

Third in a series marking Black History Month.

October 16, 2013

Georgia cardiologist returns to Atlanta to start new Permanente group

Kaiser Permanente expands to the Southeast and builds community relations …

October 8, 2013

Northwest Region started small and grew fast

Kaiser Permanente remained and opened the Northwest Region after World …

October 7, 2013

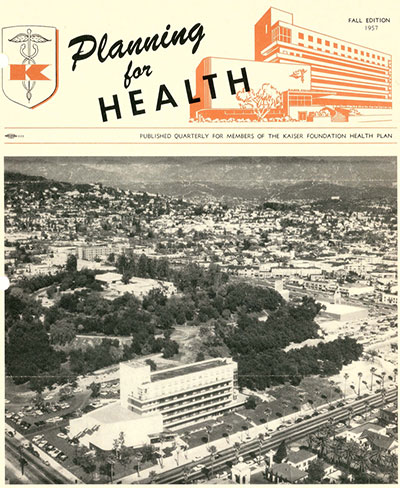

The roots of Southern California Kaiser Permanente

Kaiser Permanente Southern California started from its roots at the Fontana …

September 18, 2013

The genesis of Kaiser Permanente Colorado

Utah miners, a strike, and the need for care were the ingredients to opening …

March 6, 2013

Decades of health records fuel Kaiser Permanente research

Over 50 years of early Kaiser Permanente electronic health records since …

June 25, 2012

Early Permanente physician leader views health care future from 1966 vantage

Dr. Cecil Cutting, executive director of The Permanente Medical Group from …

February 29, 2012

Quality of care: always foremost in minds of Kaiser Permanente leaders

Kaiser Permanente doctors applied research and innovation to implement …

February 6, 2012

Latest Kaiser Permanente signature hoisted to the heights

The evolution of Kaiser Permanente's brand logo stays close to the vision …

October 7, 2010

Hawaii: Not your garden variety paradise

The history of Kaiser Permanente Hawaii and the resilience of early physicians …